What Are The Three Basic Steps Of Money Laundering

The concept of money laundering is essential to be understood for those working within the financial sector. It's a process by which dirty money is transformed into clear cash. The sources of the money in precise are legal and the money is invested in a manner that makes it appear like clean cash and conceal the identity of the felony a part of the money earned.

While executing the financial transactions and establishing relationship with the brand new customers or sustaining present prospects the obligation of adopting enough measures lie on every one who is a part of the group. The identification of such component in the beginning is easy to deal with as a substitute realizing and encountering such situations afterward within the transaction stage. The central financial institution in any nation provides complete guides to AML and CFT to combat such actions. These polices when adopted and exercised by banks religiously provide enough security to the banks to deter such conditions.

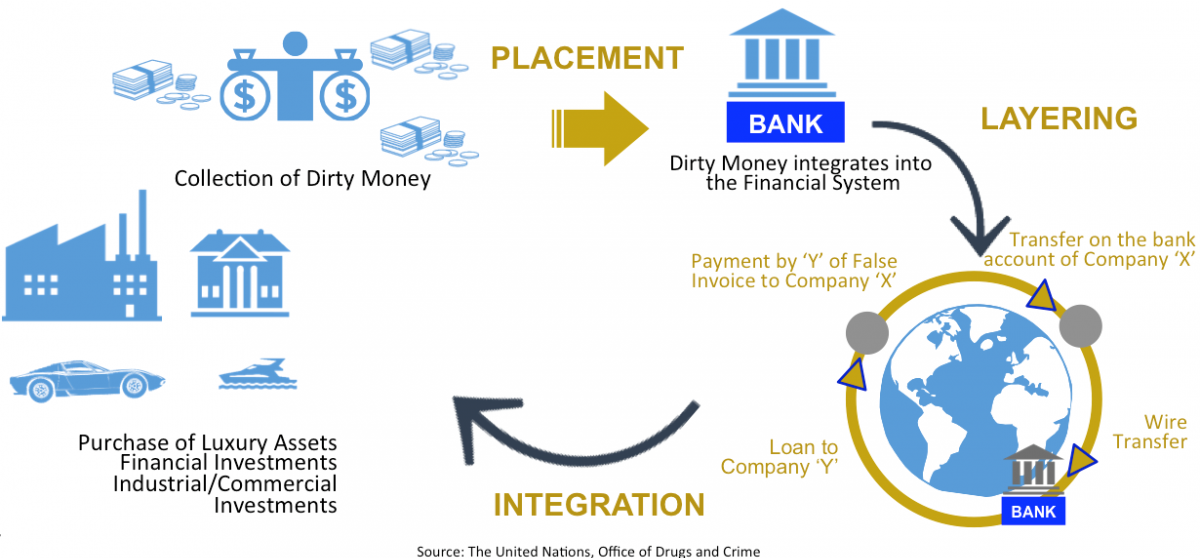

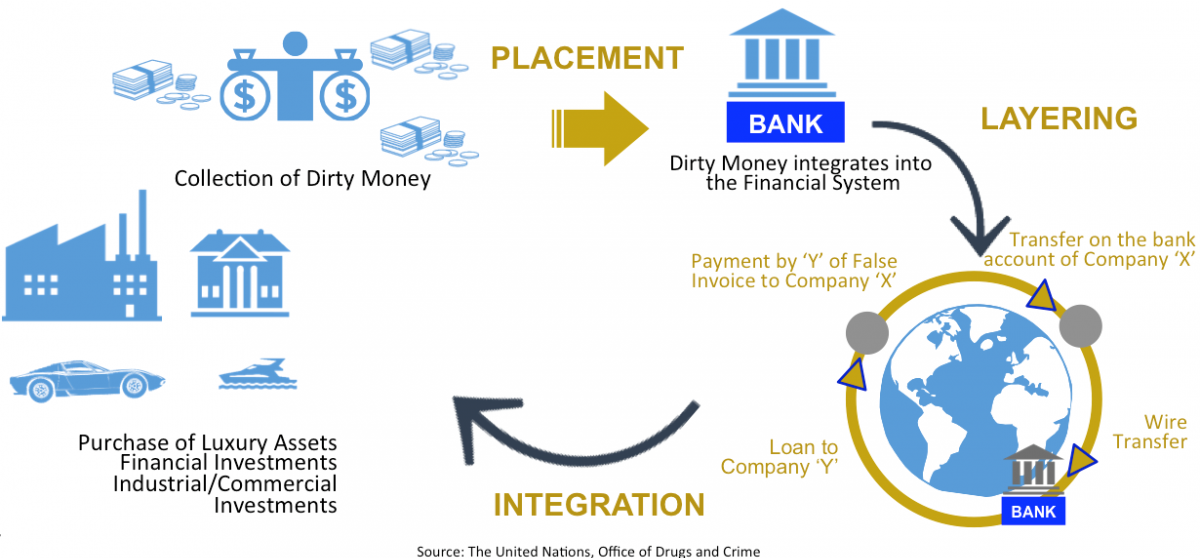

The money laundering process most commonly occurs in three key stages. Placement in which the money is introduced into the financial system.

Three Stages Of Money Laundering Download Scientific Diagram

Each individual money laundering stage can be extremely complex due to the criminal activity involved.

What are the three basic steps of money laundering. Money laundering schemes vary in their complexity and methods but there are three common phases for successful laundering. Placement is the very first step of the 3 stages of money laundering which includes moving the money into legitimate source like- casinos financial. Money laundering is the illegal movement of black money through several transactions conducted through financial infrastructure.

Money laundering involves three basic steps to disguise the source of illegally earned money and make it usable. Let us look at the individual stages. Many different techniques are used to accomplish this the most prominent being front-end companies that distribute the illicit funds back to the original launderer through legal means.

The placement stage the layering stage and the integration stage. This stage is termed as placement. Placement Layering and Integration.

There are three stages of money laundering each with a. There are three stages involved in money laundering. Money laundering has one purpose.

Three Basic Stages or Methods of Money Laundering Cycle Money Laundering Cycle Principle Layering Integration. The first step is called placement. Here are some of the most common ways this is achieved.

The Money Laundering Process. There are a number of ways or methods used for money laundering however the money laundering cycle can be broken down into three basic stages which are as follows Placement. In the first stage money enters the banking system.

Process of Money Laundering Placement. Money laundering typically occurs in three phases. Initial entry or placement is the initial movement of an amount of money earned from criminal activity into some legitimate financial network or institution.

These steps can be taken at the same time in the course of a single transaction but they can also appear in well separable forms one by one as well. 3 Steps of Money Maundering. Placement layering and integration.

1 placement 2 layering and 3 integration. The institution may be anything from a brokerage house or bank to a casino or insurance company. However it is important to remember that money laundering is a single process.

A Placement b Layering c Integration. Placement layering and integration. The money laundering cycle can be broken down into three distinct stages.

Placement can take place via cash deposit wire transfer check money order or other methods. Placement Stage Placement is the first step of money laundering which is the process of moving the money into the legitimate source via financial institutions casinos financial instruments etc. There are usually two or three phases to the laundering.

And at the same time hiding its source. There are 3 stages of money laundering. The initial stage of money laundering Placement occurs when the launderer introduces their illegal profits into the financial.

The stages of money laundering include the. Second phase involves mixing the funds. Stage 1 of Money Laundering.

To turn the proceeds of crime into cash or property that looks legitimate and can be used without suspicion. The money laundering process has three stages. The last step in the money laundering process involves converting the money so that it appears legitimate and can be incorporated into the launderers legal assets.

This is the act of moving the ill-gotten funds into a financial institution. Money laundering typically includes three stages. Traditionally it has been commonly accepted that the money laundering process comprises three main stages.

It is conducted in three stages to manipulate the authorities. Although the specific techniques used to clean dirty money vary financial experts cite three stages of money laundering in the process. Placement layering and integration stage.

Understanding Money Laundering European Institute Of Management And Finance

Basics Of Anti Money Laundering A Really Quick Primer Money Laundering Money Advice Business Advice

Three Stages Of Money Laundering Download Scientific Diagram

Money Laundering Eumcc Monetary Control Commission

What Is Money Laundering Three Methods Or Stages In Money Laundering

Understanding The Risks Of Money Laundering In Sri Lanka Daily Ft

Cryptocurrency Money Laundering Explained Bitquery

The Stages Of Money Laundering Dimension Grc

Money Laundering Stages Methods Study Com

What Are The Three Stages Of Money Laundering

Understanding Money Laundering European Institute Of Management And Finance

What Is Money Laundering Three Methods Or Stages In Money Laundering

Anti Money Laundering Overview Process And History

The world of regulations can look like a bowl of alphabet soup at instances. US money laundering regulations are no exception. We have now compiled a listing of the highest ten money laundering acronyms and their definitions. TMP Risk is consulting agency focused on defending monetary companies by lowering threat, fraud and losses. We have now massive bank expertise in operational and regulatory danger. We now have a powerful background in program administration, regulatory and operational danger as well as Lean Six Sigma and Business Course of Outsourcing.

Thus money laundering brings many hostile penalties to the group because of the risks it presents. It increases the likelihood of main dangers and the opportunity price of the bank and ultimately causes the bank to face losses.

Comments

Post a Comment