Anti Money Laundering Placement Examples

The idea of money laundering is very important to be understood for these working in the financial sector. It's a course of by which soiled money is converted into clean money. The sources of the money in precise are felony and the cash is invested in a way that makes it seem like clean money and conceal the id of the legal part of the cash earned.

Whereas executing the monetary transactions and establishing relationship with the new prospects or maintaining existing prospects the responsibility of adopting satisfactory measures lie on every one who is a part of the organization. The identification of such element in the beginning is easy to take care of as an alternative realizing and encountering such conditions afterward within the transaction stage. The central financial institution in any country supplies full guides to AML and CFT to combat such actions. These polices when adopted and exercised by banks religiously provide sufficient safety to the banks to deter such situations.

The money laundering cycle can be broken down into three distinct stages. After that the funds can be withdrawn as needed.

Money Laundering Typology Through Business Structures Entities An Overview From Company Law Perspective Sudut Pikir

The stages of money laundering.

Anti money laundering placement examples. Conceptually money laundering is pretty easy to understand. Xxxx20xx Page 1 of 13 ANTI-MONEY LAUNDERING POLICY A. Often but not in every case in the country where the funds.

Cash business paying debt with dirty money gambling real estate investments and foreign currency smuggling and exchanges. Treasury Dept RMLO Residential Mortgage Lenders and Originators. Three Stages of Money Laundering PLACEMENT.

Some examples of placement methods including blending funds with legitimate income eg. For example ten smurfs could place 1 million into financial institutions using this technique in less than two weeks. Anti-Money Laundering Policy Date Adopted.

At the placement stage for example the funds are usually processed relatively close to the under-lying activity. This stage entails placing laundered proceeds back into the economy to create the perception of legitimacy How Money Laundering Works. Placement is the act of injecting dirty money into a financial system such as a bank account or a business.

The six most common examples of crime associated to the placement stage in the laundering money process are. But Office Space creator Mike Judges farcical setup does underscore an important point. For example if the organization owns a restaurant it might inflate the daily cash receipts to funnel illegal cash through the restaurant and into the restaurants bank account.

The Shady Pizza Parlor If you need to look up money laundering in the dictionary before setting your plan in motion youre not off to a good start. These types of businesses are often referred to as fronts. Ensuring effective policies procedures human resources and technologies helps protect the organization and instills confidence in its operations.

One common layering strategy will see a customer withdraw multiple small amounts of cash from accounts where illegal funds were deposited during placement. Each cash withdrawal will be in 100 bills and in an amount too small to trigger the reporting threshold. However it is important to remember that money laundering is a single process.

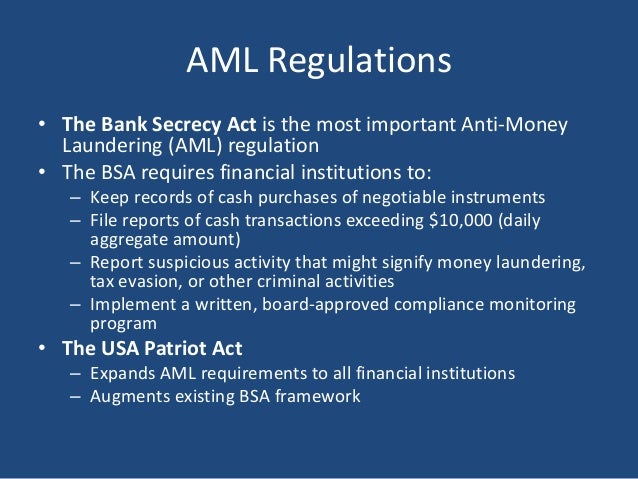

Glossary AML Anti-Money Laundering BSA Bank Secrecy Act FinCEN Financial Crimes Enforcement Network US. Best practices for Anti-Money Laundering. Placement techniques include structuring deposits in amounts to evade reporting requirements or co-mingling currency.

This process is whereby businesses blend illegal funds with legitimate takings. The entry of illegal funds into the financial system to relieve the criminal of holding and guarding dirty money. Treasury Dept OFAC Office of Foreign Assets Control US.

A Textbook Money Laundering Example. AML compliance checklist. Effective Anti-Money Laundering AML programs to ensure AML compliance are a fundamental requirement for obliged entities.

Money laundering activity may also be concentrated geographically according to the stage the laundered funds have reached. Money Laundering Example One of the most commonly used and simpler methods of washing money is by funneling it through a restaurant or other business where there are a. For example the purchases of property artwork jewelry or high-end automobiles are common ways for the launderer to enjoy their illegal profits without necessarily drawing attention to themselves.

Pdf International Anti Money Laundering Programs

Prevention Of Money Laundering And Terrorist Financing 22

Legal Regime For Aml Anti Money Laundering In

What Is Anti Money Laundering Aml Anti Money Laundering

Revised Central Bank Amla Guidelines Anti Money Laundering

Anti Money Laundering Aml Regulation And Implementation In Chin Pdf Money Laundering Financial Action Task Force On Money Laundering

Anti Money Laundering Overview Process And History

International Banking Wealth Management Aml Quality Control Effective Anti Money Laundering Prezentaciya Onlajn

Ppt Anti Money Laundering Awareness Training Powerpoint Presentation Id 730997

Money Chaussureslouboutin Soldes Fr

Pdf Anti Money Laundering Regulations And Its Effectiveness

Stages Of Money Laundering Https Tinyurl Com Tdxavfc Socialbookmarking Seo Backlinks Onlinemarketing Influen Money Laundering Social Bookmarking Money

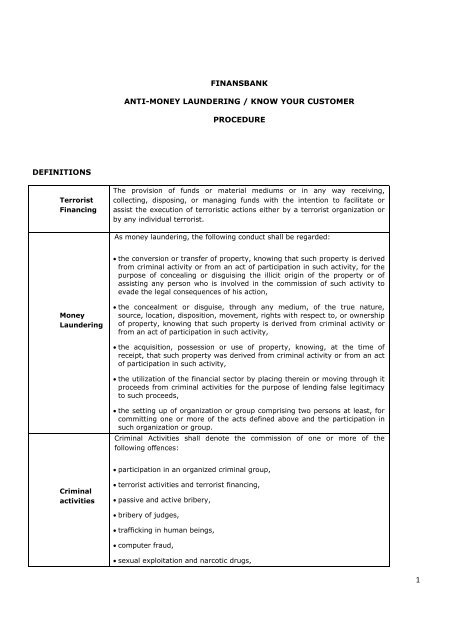

Finansbank Anti Money Laundering Know Your Customer Procedure

Legal Regime For Aml Anti Money Laundering In

The world of regulations can seem like a bowl of alphabet soup at occasions. US cash laundering laws are not any exception. We have compiled an inventory of the highest ten cash laundering acronyms and their definitions. TMP Danger is consulting firm focused on defending monetary companies by decreasing risk, fraud and losses. Now we have massive financial institution experience in operational and regulatory threat. We have now a strong background in program administration, regulatory and operational risk in addition to Lean Six Sigma and Business Process Outsourcing.

Thus money laundering brings many antagonistic consequences to the group as a result of dangers it presents. It will increase the likelihood of main dangers and the chance cost of the bank and ultimately causes the bank to face losses.

Comments

Post a Comment